-

Arthur Werner – 2020 Federal Income Tax Update – Business

Description

The next four parts of this course entail the logistics of Third-Party Settlements, Employee Retention, Section 199A and Educator’s Above-The-Line Deductions, and many other tax specifics. The forms associated with these various tax elements may seem complicated, but this course will educate you on the nuances of navigating these and other tax categories.

The goal is to put you as the practitioner in a position where you can answer questions, make recommendations, and advise your clients accordingly, putting them at ease. It is expected to be a busy upcoming tax season. The information in this course will aid you in educating clients of their filing options and ensure they properly ascertain their financial position and qualifying factors during tax time.

These courses may be taken à la carte or as a full program.

**Please Note: If you need credit reported to the IRS for this IRS approved program (8 Hours Only), please download the IRS CE request form on the Course Materials Tab and submit to [email protected].

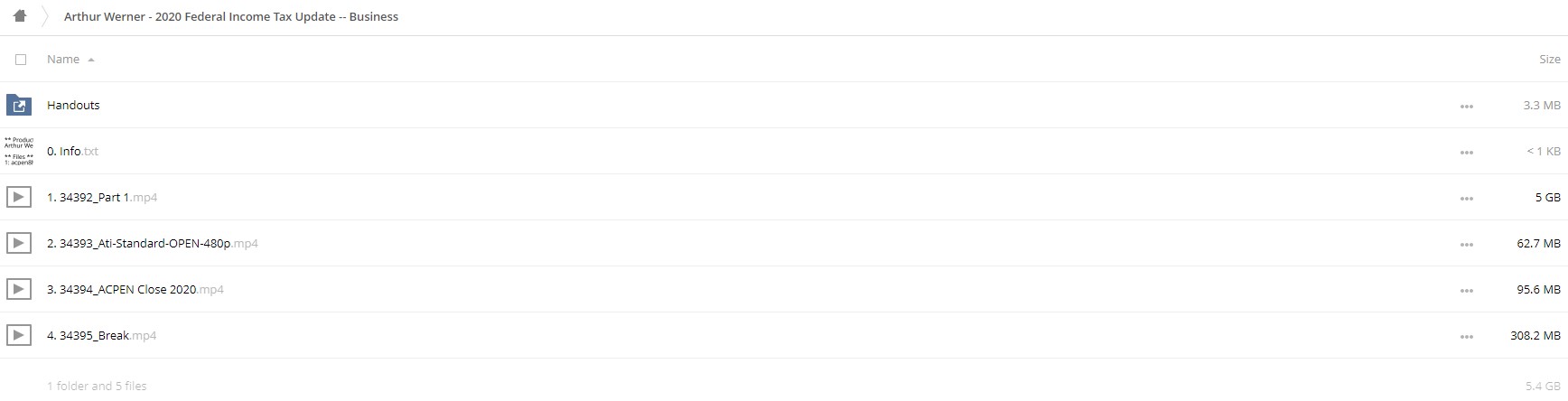

Handouts

| Important CPE Credit Information_READ BEFORE WEBCAST UPDATED (0.47 MB) | Available after Purchase | ||

| Slides Handout (2.7 MB) | Available after Purchase | ||

| IRS CE Credit Request Form (137 KB) | Available after Purchase | ||

| 2020 Federal Income Tax Update — Business_Q&A (12 KB) | Available after Purchase |

Faculty

Arthur Werner Related seminars and products: 2

Werner-Rocca Seminars, Ltd.

Arthur Joseph Werner, JD, MS (Taxation), is the president and is a shareholder in the lecture firm of Werner-Rocca Seminars, Ltd. Mr. Werner’s lecture topic specialties include business, tax, financial and estate planning for high net worth individuals. In addition, Mr. Werner is an adjunct professor of taxation in the Master of Science in Taxation program at the Philadelphia University. Mr. Werner received his B.S. in Accounting and his M.S. in Taxation from Widener University. He holds a J.D. in Law from the Delaware Law School.

Mr. Werner lectures extensively in the areas of Estate Planning, Financial Planning, and Estate and Gift Taxation to Certified Public Accountants and Financial Planners, and has presented well in excess of 2500 eight-hour seminars over the past twenty-five years as well as numerous webinars and video presentations. Mr. Werner has been rated as having the highest speaker knowledge in his home state of Pennsylvania by the Pennsylvania Institute of Certified Public Accountants, was awarded the AICPA Outstanding Discussion Leader Award in the State of Nevada, the Florida Institute of CPAs Outstanding Discussion Leader Award, and the South Carolina Association of CPAs Outstanding Discussion Leader Award.

Instant Access Available

Product Content

Get Instant Access Arthur Werner – 2020 Federal Income Tax Update – Business at Offimc.click Now!

Salepage: https://agaboston.ce21.com//item/2020-federal-income-tax-update-business-400500

Archive: https://archive.ph/wip/8lkpE

Delivery Information

- Upon ordering the product, a delivery email with download instructions will be sent immediately to you so that you may download your files. If you log in (or create an account) prior to purchase you will also be able to access your downloads from your account dashboard.

- It is a digital download, so please download the order items and save them to your hard drive. In case the link is broken for any reason, please contact us and we will resend the new download link to you.

- If you don't receive the download link, please don’t worry about that. We will update and notify you as soon as possible from 8:00 AM – 8:00 PM (UTC+8).

- Please Contact Us if there are any further questions or concerns you may have. We are always happy to assist!

10 reviews for 2020 Federal Income Tax Update – Business – Arthur Werner

There are no reviews yet.