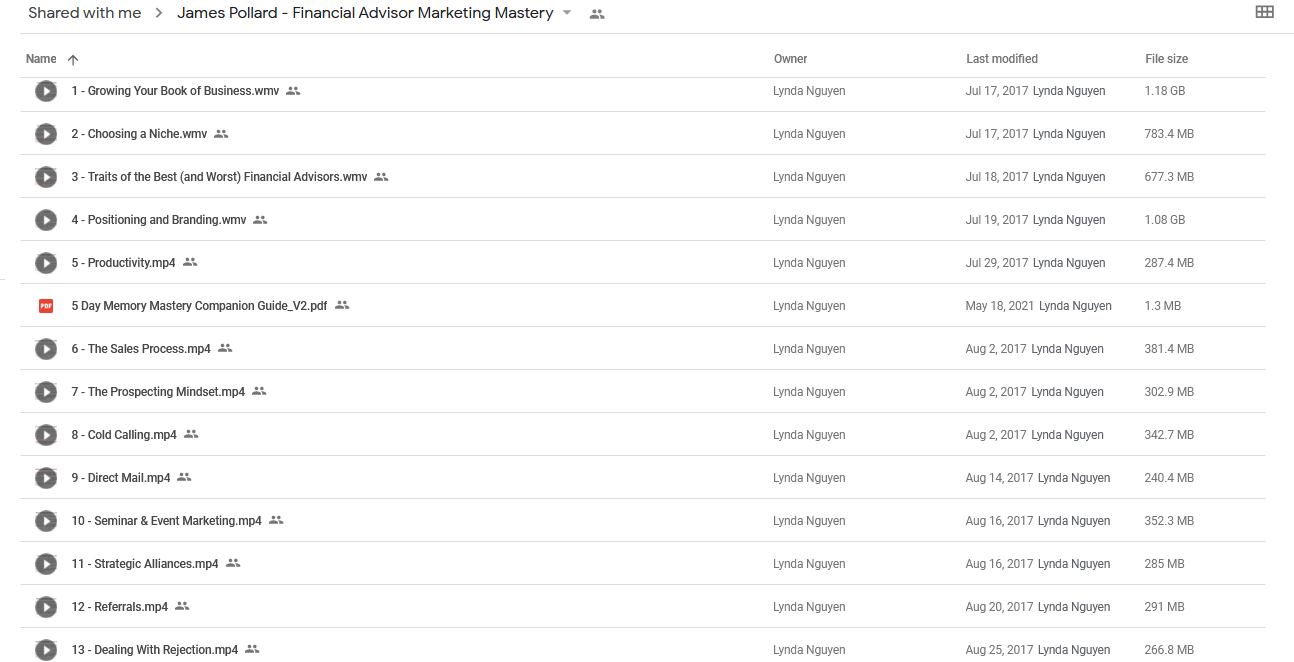

James Pollard – Financial Advisor Marketing Mastery

“If Rookie Financial Advisors With No Experience And No Credentials Can Use This To Get Clients With Ease… What Can You Do?”

Monday, October 11, 2021

WARNING: This is one of the worst sales letters you’ll ever read.

Why?

Because it contains a lot of “teaching”, which is often viewed as a no-no when selling. Yet, in reading this, you can gain a great deal of insight on what it takes to get more clients as a financial advisor.

You may even gain some tips you’ll want to act on right away. Which means reading this letter in and of itself could be profitable to you.

Also, because this letter is about how you will live the rest of your life. As a financial advisor, your livelihood depends on the topics I’m going to discuss here.

And at the end of this letter, I’m going to ask you to make an important and, frankly, not inexpensive decision, so you probably want a lot of information.

Now…

If You’re Ready To Get More Clients, Your Life Is About To Change Forever. Here’s Why…

Financial advising can be a lucrative field… if you know how to market your services correctly.

In fact, the U.S. Bureau of Labor Statistics reports the top 10% of financial advisors earn over $208,000 per year.

The top 1% makes MUCH more. I’m talking millions.

And our financial services industry is growing – it’s expected to grow by double digits in the next few years.

Which means if you’re a financial advisor, you have the opportunity of a lifetime. Don’t let it slip through your fingers.

However, it won’t be easy…

Because according to a report from research and consulting firm Cerulli Associates, there are 310,504 financial advisors in the United States alone and every single one wants to eat your lunch.

So, how do you crush the competition, get more clients, and win the life you deserve?

Here’s how…

But First, Read This Disclaimer…

Please understand that my results are not typical. I’m not implying you’ll duplicate them (or do anything for that matter).

The average person who buys any “how to” information gets little to no results. As with all of my products, my references are being used for example purposes only.

I’ve had years of experience getting clients and my personal results should be considered exceptional.

Your results will vary and depend on many factors… including but not limited to your background, experience, and work ethic.

All business entails risk as well as massive and consistent effort and action. If you’re not willing to accept that, please DO NOT GET THIS.

With that said, let me show you…

Exactly What You’re Getting…

Hi, my name is James Pollard and I’m the founder of this site, TheAdvisorCoach.com.

I’ve written literally hundreds of business-building articles for financial advisors over the years.

Published a bunch of books.

And I even do a weekly podcast called “Financial Advisor Marketing”.

I’ll cut straight to the case: I’ve put together this course, designed to help financial advisors build their businesses.

If you’re someone who requires the best, most-effective business-building information, this is it.

It’s my flagship product. The mack-daddy, if you will.

It’s called “Financial Advisor Marketing Mastery” and it’s an online course with over 11 hours of video content giving you a road map to grow your book of business and get more clients.

You Can Easily Recoup Your Investment Many Times Over…

Why?

Because it’s guaranteed to be worth at least 10 times the cost or you pay nothing.

I know that may seem like a bold claim but it’s actually very conservative. To prove it, here’s a small sample of what you’ll discover in the videos….

Video 1: Growing Your Book of Business

- The single most-important core purpose which should be behind all business planning you ever do. (Getting this wrong will DESTROY your client-getting efforts and has led more financial advisors to failure than perhaps anything else. This one thing could pay for the entire course right here.)

- The only 2 ways to make more money as a financial advisor. (Not doing these two things leads advisors to mediocre incomes and humdrum businesses.)

- How to develop a step-by-step plan to get more clients. (Once you do this, it’s like painting by numbers – all you have to do is follow the steps.)

- Little-known characteristics people want from their financial advisors. (Sadly, most financial advisors are exhibiting the exact opposite characteristics and patting themselves on the back while doing so.)

- The shocking ways people REALLY choose their financial advisors. (This is stuff no prospect will ever openly admit but having this “insider information” makes you significantly more likely to convert your prospects into clients.)

- How to build instant trust with your prospects. (If you pay attention, you may notice television evangelists using this technique to get donations… or talk show hosts using it to get their guests to reveal personal information on live TV. It works just as well when getting people to talk about their financial lives.)

- The “stealth” way to audit your competition’s strengths and weaknesses. (This is arguably the most powerful way to rapidly grow a financial advisor’s business because you can “copy and paste” your competition’s strong points and expose their weak ones.)

- Four metrics you must track on a regular basis. (Legendary business mind Peter Drucker said, “What gets measured, gets done.” And in every case I’ve seen so far, tracking these four things has led to a demonstrable positive improvement in revenue.)

Video 2: Niche Marketing

- How to pick a niche market. (Most financial advisors struggle with this but I break it down into a step-by-step process which makes picking the perfect target market like child’s play.)

- Why “casting a wide net” makes your marketing less effective. (Yes, I’ve already established that you need a niche, yet most advisors still go too wide within their niches. I’ll show you the “second layer” almost nobody talks about.)

- The #1 easiest way to “sniff out” your prospects’ unspoken objections. (This strategy works so well that one financial advisor I know got accused of being a mind-reader.)

- 5 of the best niches for you to target right now. (These five specific markets have been proven to work exceptionally well with financial advisors.)

Video 3: Traits of the Best (And Worst) Financial Advisors

- What the world’s richest advisors do that other advisors often miss. (You’ll be surprised at how deceptively simple this is.)

- The critical follow-up mistake financial advisors make which destroys all chances of getting an appointment. (One commonly cited statistic says that 80% of sales are lost because of this one mistake alone.)

- 3 follow-up statistics that, once applied, can dramatically increase the number of prospects turning into clients. (In fact, I’ve never seen a case where applying these simple ideas didn’t lead to a boost in revenue.)

- A sample 7-week follow-up campaign designed to convert prospects into clients. (It doesn’t get any easier than this – you can install this “plug and play” approach into your business right away because I’ve done the hard work for you.)

- Why prospects who already have financial advisors should be prioritized above all others. (Smart financial advisors realize that people who already have advisors are often the easiest prospects to convert and I’ll show you how to do it.)

- 87% of people FIRE their financial advisors for this one reason. (This is closely related to why people with advisors make the best prospects. Pay attention to this tip because it can prevent years of headache and heartache.)

Video 4: Positioning and Branding

- 5 characteristics of the world’s best personal brands. (Well-known celebrities like Taylor Swift, Barack Obama, and Oprah Winfrey have mastered these characteristics. They can be applied directly to financial advisors to unleash a flood of new prospects.)

- How to demolish your prospect’s price objection and charge what you’re really worth every time. (Warning: if you think charging a lot of money is somehow “wrong” or “immoral”, skip this section.)

- 4 ways to build trust with your prospects and clients. (The fourth tip might make you uncomfortable but it can be one of the most profitable things you ever do.)

- The often-overlooked way to leverage your time and build a massive pipeline in one fell swoop. (I’ve seen financial advisors go from an empty pipeline to dozens of qualified prospects literally overnight.)

- 3 things prospects want from financial advisors, ranked in order of importance. (Some financial advisors have this backward. Simply by “rearranging” their approach, financial advisors can build their businesses faster.)

- Exactly how to find trade associations within your target market. (This takes less than five minutes to do, which means you can have your next speaking gig lined up by tonight.)

- How to overcome a meeting planner’s two basic fears so you get booked to speak at seminars, trade shows, and conferences. (Most financial advisors fail to speak in front of large audiences because of one or both of these two things. Eliminate these and you’ll get booked more often and speak to more prospects.)

- 6 things to include in your client evaluation forms. (Most financial advisors’ evaluation forms are either too skimpy or too complex. In reality, you only need these six things.)

Video 5: Productivity

- Weird – yet effective – ways to boost your productivity to get more done than ever before. (Here’s a valuable life lesson – if you want your bank account to be different from most people… who are broke… then you’ve got to do different things. Sometimes those things may seem a little odd.)

- Why increased results alone can be misleading. (Case in point: some financial advisors get MORE clients but make LESS money. I’ll show you how to prevent this from happening.)

- 3 ways you can achieve maximum productivity with minimum effort. (Warning: people may think you’re slacking or even call you lazy but you’ll be laughing all the way to the bank.)

- The little-known “competition” hack which can double your productivity in record time. (This works EXTREMELY well if you’re a competitive person because it allows you to leverage one of your greatest strengths.)

- The stupidest mistake you can make when trying to become more productive. (Financial advisors who do this one thing might as well flush their money down the toilet.)

Video 6: The Sales Process

- 3 reasons why traditional sales advice doesn’t work for financial advisors. (I’ve even found that some of the most successful financial advisors have never read a book on sales. They got so successful because they didn’t have to “unlearn” any bad habits.)

- 4 ways to boost your credibility so you can take someone from a cold lead to paying client in less time than ever before. (Credibility is the foundation of all client-advisor relationships, yet most advisors take too long to establish it. I’ll show you a better way.)

- 3 questions your prospects are asking themselves when they decide whether or not to trust you. (If you fail to answer these three questions, you will never get your prospects’ trust and you will fail to convert them into clients.)

- How to shortcut a prospect’s “evaluation period” so you hear a “yes”, faster. (One advisor told me about one prospect who swore up and down he was “shopping around”… yet, the prospect called the advisor back in less than four hours saying he was ready to move forward.)

- 3 ways financial advisors appear too “salesy”. (Any one of these three things is enough to scare prospects and clients away for good. Fix these things and you will begin to attract new business with relative ease.)

Video 7: The Prospecting Mindset

- The #1 easiest way to overcome prospecting reluctance. (I’ve read tons of books and attended dozens of trainings – this is the ONLY thing that has ever worked for me and countless financial advisors.)

- Why prospecting is NOT a “selling” activity. (Too many financial advisors get this wrong because they think they should be “selling” while prospecting. Prospecting is simply the act of qualifying your leads – if you understand that, things become easier for you.)

- 6 dangerous thoughts about prospecting keeping you from reaching your maximum potential. (These are arguably the most dangerous limiting beliefs a financial advisor can have. Sadly, virtually 100% of advisors have at least one of them.)

- How to cut your prospecting time in half and still make the same amount of money. (This works so well that I’ve had offers from major companies to teach it to their staff. I politely declined and instead revealed it here, in this video.)

- 4 things low-performing financial advisors do that high-performing advisors don’t. (When I work with an advisor one-on-one, I look for these four things right away. If the advisor stops doing them, a significant income boost is virtually certain to follow.)

- 2 mindset shifts you must have to become a superstar prospector. (If you have any trouble whatsoever with prospecting for new clients, these two mindset shifts can help you “wipe the slate clean” and transform your business overnight.)

Video 8: Cold Calling

- 2 things the best cold callers in the world from people who flop on every call. (These two things enabled “The Wolf of Wall Street” to make hundreds of millions of dollars from cold calls alone.)

- The #1 best way to leave a voicemail which makes prospects desperate to call you back. (If you’re hesitant or skeptical about doing this, try it out on complete strangers to prove to yourself that it works like magic. Then, apply it to your own prospects.)

- How to conquer the most difficult part of cold calling in five minutes or less. (Okay, I’ll spill the beans – the most difficult part is getting started. Fortunately, I’ve come across a simple little exercise which helps you banish all reluctance to picking up the phone.)

- Why cold calling is NOT about trying to find new clients (and what you should do instead).

- 11 surefire ways to generate an endless amount of leads. (After this section, you will have no excuse for having an empty pipeline ever again.)

- 3 cold calling metrics you should track on a regular basis. (You’ve probably figured out by now that I’m a huge advocate of tracking. By tracking these things, your calls can become two or three times as effective in the next few months.)

- How to do pre-call research to maximize your chances of having a successful call. (By doing a little research – the right way – I’ve seen advisors get as much as a 72% increase in the number of appointments set.)

Video 9: Direct Mail

- Why the majority of advisors fail with direct mail. (There are even sayings like “if you mail, you fail” but I’ve discovered that if you follow a certain step-by-step formula, you dramatically increase your odds of having a winner.)

- How to track your direct mail efforts to ensure you get a positive return-on-investment. (70% of Americans say “snail mail” is more personal than the Internet, so if you’re not leveraging direct mail, you’re leaving a lot of money on the table.)

- One “tweak” to your direct mail pieces which could easily double your response. (Again, I encourage you to test all of this out for yourself. Don’t take my word for it. Try it on a small scale before rolling it out to thousands.)

- When to send a postcard and when to send a letter. (Too many advisors send one or the other… and they send them at the exact wrong time. It may seem like a subtle difference but it can have a major impact on your bottom line.)

- 6 ways to immediately boost your response. (I want you to apply these six things to your best-performing direct mail piece. When it brings in more responses than ever before, I want you to send me a thank-you note.)

- My 3-step “magic formula” to orchestrate a successful mailing, every time. (If you’ve ever gotten any mail from me, you already have a glimpse of my process. In this part of the video, I’m “pulling back the curtain” and revealing exactly what I do and why.)

Video 10: Seminar and Event Marketing

- 5 of the biggest seminar mistakes financial advisors make. (Don’t even THINK about getting in front of an audience until you know what these are.)

- The #1 best way to get more people to show up to your seminar than ever before. (With this strategy, you have to be careful not to overbook your venue.)

- 4 terrible seminar locations to avoid like the plague. (Unfortunately, these are the most common seminar locations and they actually predispose people to avoid doing business with you.)

- 3 major keys to keep in mind when following up with your seminar attendees. (Doing this will allow you to convert skeptical prospects in less time than ever before, leaving you eager to conduct another seminar and do it all over again.)

- 9 places where you can speak to a “captive audience”, meaning you don’t have to send out any invitations. (I’ve done all the hard work for you by literally giving you these nine locations – all you have to do is reach out and ask to speak.)

- The overlooked, ultra-low-cost way to present dozens, perhaps hundreds, of people at the same time. (It’s NOT a seminar, although it’s pretty similar. I’ve only done it a few times, but I’ve had stellar results every time.)

- 7 topic ideas you can “plug-and-play” into your next seminar or event. (Again, I’ve done all the hard work for you because these seminar topics are proven client generators. A lot of financial advisors fail with seminars because they don’t choose the right topics. Use any of these seven and you’ll stack the odds in your favor.)

Video 11: Strategic Alliances

- The math behind generating $6 million in new AUM every single year with strategic alliances. (It won’t happen overnight, yet it’s easier than you think. This is another area where this course could effortlessly pay for itself several times over.)

- 2 “big rules” you must remember when cultivating strategic alliance relationships. (Whatever you do, don’t avoid these rules. Doing so will set you up for failure and get you laughed right out of their offices.)

- The MASSIVE problem you want to solve for CPAs. (This is like a “magic button” because whenever you shine a spotlight on this problem, the CPA will virtually beg to send you referrals.)

- 4 techniques that almost never work when trying to develop a referral relationship. (Unfortunately, the “experts” and “gurus” are teaching financial advisors to try to build relationships with some or all of these four things.)

- What to do when a strategic alliance tells you “I don’t give referrals”. (When they say this, it’s usually a test. How you respond will make the difference between walking away defeated and getting several referrals per year.)

- 5 talking points to use during your initial meeting with a strategic alliance. (One of the biggest challenges financial advisors face when forming strategic alliances is knowing what to talk about with CPAs, attorneys, etc. – that’s why I’m literally GIVING you five of the best talking points to use. However, once they start talking, you may not be able to get them to shut up.)

Video 12: Referrals

- The stupidest mistake financial advisors make when attempting to get referrals. (I’ve seen intelligent, likable, and otherwise competent financial advisors fail to get referrals because they made this one fatal mistake.)

- 4 eye-opening referral statistics which highlight why referrals should be part of your overall marketing strategy. (In other words, not having a strong referral process in your business is no longer an “option” if you want to join the ranks of the world’s highest-paid advisors.)

- Why nearly all advisors fail at getting referrals. (I’ll give you a hint: the referral should NOT be about you.)

- The most important thing to do before asking for a referral. (If you don’t do this one thing first, you have virtually no chance of getting a referral.)

- How to ask for referrals… the right way. (None of the stupid, “Who do you know?” or “I get paid in two ways” crap.)

Video 13: Your Website

- Tried-and-true ways to make your website generate leads for you 24/7… even if you’ve never gotten leads from your website before. (In one instance, I saw an advisor implement these strategies into his website and get his first lead less than 48 hours later.)

- The biggest lie financial advisors tell themselves about their website. (If you’ve fallen victim to this lie, it’s costing you money every day.)

- A website’s “secret weapon” which most financial advisors don’t even know exists. (Incorporate this into your site and you’ll have an edge over your competitors.)

- 2 surefire ways to build trust with your website. (These two specific things have been shown to melt your prospects’ skepticism and dramatically increase the likelihood of them booking an appointment with you.)

- The dumbest mistake financial advisors make with their websites. (This mistake is increasingly common and it’s a surefire way to turn off any prospect who visits.)

Video 14: Content Marketing

- The #1 easiest way to generate amazing pieces of content that generate inbound leads whether you’re asleep, working, or on vacation. (Don’t worry, you don’t have to be a writer in order to do this.)

- 4 reasons why content marketing is one of the most profitable marketing strategies for financial advisors. (One of my private coaching clients leverages content marketing so well that it allows him to take two months off every year.)

- How to double your content marketing’s inbound leads with this simple tweak. (I did this on my own website and actually got a 627% improvement, but doubling your inbound leads is a more realistic expectation.)

- 3 “superpowers” which lets content marketing cost 62% less than traditional marketing and still generate 300% more leads. (I’ve incorporated these three things into my own website – the fact that you’re reading this right now is proof that they work.)

- How to generate endless content ideas. (I’m living proof that this works because I have hundreds of articles throughout the web, a weekly podcast, a monthly newsletter, and still send out daily emails.)

Video 15: Email Marketing

- The counterintuitive “secret” about why deleting your email subscribers is sometimes the best move you can make. (In fact, deleting your email subscribers could SAVE you money… and it could be enough to pay for this course in full.)

- 7 email marketing metrics you must track on a regular basis. (I admit it, I’m fanatical about tracking. Unfortunately, many advisors don’t have a clue if their email marketing strategy is working or not. I’ll help you fix all that with these seven things.)

- How I consistently create emails which get opened, read, and clicked. (I have this down to a science and I use it on a daily basis.)

- How to track your return-on-investment from email marketing. (Once you get finished watching this, you’ll be able to figure out exactly how much money your email campaign is making you, down to the dollar and the day.)

- 4 things to keep in mind every time you send an email. (These four things will help you avoid spam filters and ensure your recipients are thrilled every time they see your name in their inbox.)

- A 13-day sample autoresponder series I designed to take someone from a cold lead to a potential client. (It’s scary how effective this is because it can literally generate appointments on autopilot.)

- 7 of my best-performing subject lines you can copy-and-paste into your own emails. (You’re getting years of my hard work and split-tests handed to you on a silver platter.)

- The single most profitable email marketing secret I have ever discovered. (I have NEVER revealed this secret anywhere until this course.)

Video 16: Facebook Marketing

- 5 reasons you should use Facebook and why it’s one of the most underrated tools in marketing today. (Most advisors don’t even know how to use Facebook effectively. Only a rare few are using it to extract more leads than they can possibly handle.)

- Exactly how to use Facebook to get in front of your target market and remain top-of-mind. (When they’re ready to hire a financial advisor, you’ll be the first one they call.)

- 4 reasons why you see what you see on your newsfeed. (Knowing how this content gets there is like knowing the “cheat code” to push your content in front of your prospects.)

- 3 things I wish I knew about Facebook ads before I started. (I had to learn these things the hard way and you get them spoon-fed to you.)

Instant Access Available

Product Content

Get Instant Download James Pollard – Financial Advisor Marketing Mastery at Offimc.click Now!

Sale Page:https://www.theadvisorcoach.com/famm.html

Delivery Information

- Upon ordering the product, a delivery email with download instructions will be sent immediately to you so that you may download your files. If you log in (or create an account) prior to purchase you will also be able to access your downloads from your account dashboard.

- It is a digital download, so please download the order items and save them to your hard drive. In case the link is broken for any reason, please contact us and we will resend the new download link to you.

- If you don't receive the download link, please don’t worry about that. We will update and notify you as soon as possible from 8:00 AM – 8:00 PM (UTC+8).

- Please Contact Us if there are any further questions or concerns you may have. We are always happy to assist!

Reviews

There are no reviews yet.