Joe Ross – Spread Trading Webinar

WHY TRADE FUTURES SPREADS?

YOU NEED TO KNOW!

STOP RUNNING is the worst enemy of a trader. Just about the time you think you are winning, market direction changes and moves sharply against you. Your stop is hit; you’re out. Then the market moves the way you thought it would, and you are left behind with a loss. What if I told you that you can trade in an arena where there is no stop running? Would that not make your trading more relaxed?

How many times have you taken major slippage because you inadvertently entered a market when liquidity was almost non-existent?

| In my futures trading webinar I can show you how to trade in such a way that you can make profitable trades at times when even the most liquid markets are illiquid due to traders standing around waiting for a government financial or agricultural report. Would you find it a lot easier to trade if all you had to do was to spend a couple of hours a week selecting trades that have at least an 80% probability of winning? What if I said you can find trades where often the margin for entry and maintenance is only 10% of the margin required for non-spread trading in the outright futures? Futures spread trading offers the most efficient use of your trading capital that is possible in trading anything. Spread trading has more leverage than any other form of trading, while at the same time having less volatility than any other form of trading. |  |

Are you aware of one of the one of the greatest secrets in trading?

There is a flaw in the way margins are computed for spreads. Do you know what it is? You will learn it during the seminar on trading spreads. That secret is worth a fortune.

Do you know why spread trading is hardly mentioned in any book, or on websites, or by exchanges, or by your broker? You need to find out why! You will be amazed.

Do you know how to make money when markets are moving sideways? You can take plenty of profits out of sideways markets if you know how to trade spreads.

We are not talking about option spreads here. What we are telling you are just a few of the features and outstanding benefits of spreading one futures contract against another.

There is more, much more. Here is a partial list of benefits and what you will learn during this Spread Trading Online Video Seminar©:

- Market Dynamics — market dynamics will show you: where prices will probably move next; why prices move to where they do move; how far prices are likely to move; how they are moved; and who moves them. Knowing all this information will almost surely cause you to want to trade spreads.

- How to avoid stop running. No one wants his stop-loss order to be filled. Place yourself in a situation in which every order you place in the market is an order you want to be filled.

- Learn why spreads exist, and who uses them. You will find that you can be among the select few.

- Learn what spreads do, and the rationale for spreading.

- Learn about the 5 categories of trades.

- Learn about arbitrage and how that helps spread traders.

- Learn why spread trading offers much lower risk than trading in outright futures.

- Learn why spreads offer the lowest of all margin requirements. Lower even than trading options.

- Learn how to trade 10 spreads for the same amount of capital you would have to put up for one futures contract. Spreads are the most efficient use of capital in the world of trading.

- Learn why spreads are less volatile than futures.

- Learn how spread protect you in a limit move.

- Learn why Spreads trend more often, more steeply, and for longer than outright futures.

- Learn why spread require less liquidity than outright futures.

- Learn why you are less concerned with slippage when spread trading than you are when trading anything else.

- When you trade forex, stocks, options, or outright futures, your chances of winning on any single trade are never greater than 50%. But there is a situation when trading spreads where the odds increase to 67%.

- Learn why it is better to be in a spread during a falling inverted marketthan it is to be short in outright futures.

- Learn about the crush and crack spreads. The big traders do them, and so can you.

- Learn how to structure a spread, and how to place spread orders.

- Learn how to manage spread trades. You need to know how to do money, trade, and risk management. All of these are taught in the seminar.

- Learn about seasonality in spreads.

- Learn about regression analysis spreads.

- Learn about observation spreads.

- Learn how to create your own spread library of tradable spreads you can do year-in and year-out.

- Learn where you can find excellent free spread charts.

- See step-by-step how to select spreads, how to determine how many spreads to trade, how to determine risk, and how to determine profit goals.

- See in which markets you can day trade spreads.

- See where to find acceptable spreads.

- See why spreads trades can be planned months in advance.

- See where to find unit values; essential for trading and correctly charting spreads.

- See how to use the Traders Trick™ when trading spreads.

- See how to filter spreads so you take only the best.

HAVE YOU BEEN MISSING OUT ON ALL THE WONDERFUL BENEFITS OF SPREAD TRADING?

YOU DON’T HAVE TO MISS OUT ANY LONGER!

THE SPREAD SEMINAR WILL

TEACH YOU WHAT YOU NEED TO KNOW.

REQUIREMENTS:

All you need to take and study my online video about Spread Trading is time, your computer with internet access, and a valid e-mail address.

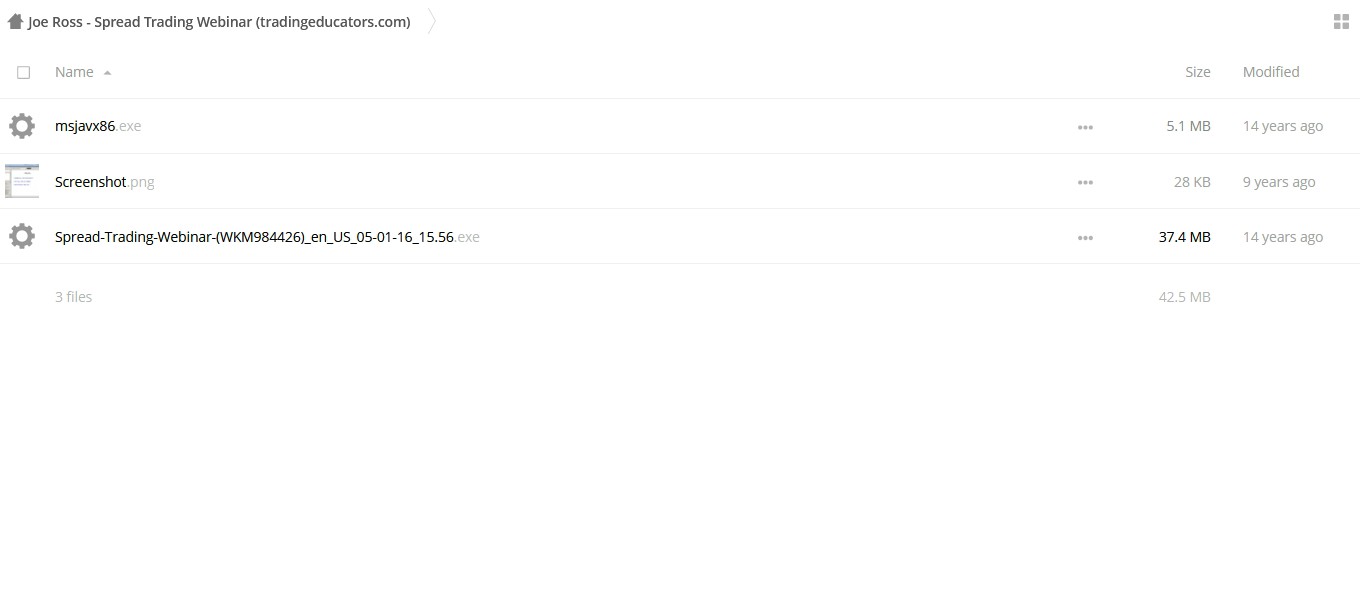

Be aware: the total size of all the video files is 605 MB. Depending on your bandwidth or your ISP (Internet Service Provider) and where you live, it might take a while to download all 6 files. Since the time varies, we cannot give any precise figures. Please plan to make time available.

You have 72 hours (3 days) in which to watch the complete online seminar course, starting from the time you click “play” on the first video. The entire course takes a total of 5.6 hours to watch, so you obviously have time to take breaks, replay parts you want to remember or clarify, and study the material in depth. You will also be able to download a printable version of the seminar to study at your leisure. It’s yours to keep forever.

Why do I have only 3 days to watch the entire seminar? If you took our live seminar on Spread Trading you would attend only 2 days and have very little time to take notes and to ask questions. But with the online seminar we give you 1 extra day to dive into the details of the seminar material and repeat each section numerous times during those 3 days. Plus you can ask questions via e-mail, or on our forum.

Instant Access Available

Downloadable Content

Get Instant Download Joe Ross – Spread Trading Webinar at Offimc.click Now!

Delivery Information

- Upon ordering the product, a delivery email with download instructions will be sent immediately to you so that you may download your files. If you log in (or create an account) prior to purchase you will also be able to access your downloads from your account dashboard.

- It is a digital download, so please download the order items and save them to your hard drive. In case the link is broken for any reason, please contact us and we will resend the new download link to you.

- If you don't receive the download link, please don’t worry about that. We will update and notify you as soon as possible from 8:00 AM – 8:00 PM (UTC+8).

- Please Contact Us if there are any further questions or concerns you may have. We are always happy to assist!

7 reviews for Spread Trading Webinar – Joe Ross

There are no reviews yet.